There are 64 critical technologies that will control the future of the world, and incredibly China now controls 90% of them. But it wasn't always like this. In fact, 20 years ago it was the United States who controlled 60 of the 64 technologies, but over the past decade China has overpowered the US and now firmly sits in the driver's seat to lead the future of our world.

This new information was published in a new report entitled “Critical Technology Tracker: The Rewards of Long Term Research Investment”. It was written by ASPI, an Australian think tank who ironically receives funding from the US State Department and Military Industrial Complex.

In other words, this organization is anything but pro-China. Everyone knows China has been the world’s factory for the past 4 decades. But in recent years, China has shifted from being a manufacturing powerhouse to a research powerhouse and now dominates advanced fields like AI, renewable energy, biotech, space, and quantum computing.

The Economist even admitted earlier this year that China is now a scientific superpower. 10 years ago, Harvard Business Review published a research paper claiming that China isn’t able to innovate announcing China is full of uncreative, rule-bound learners who won’t be able to contribute to innovation. But fast forward a decade and China now produces five times the amount of high-impact research than the United States.

While the US government has been funding wars and regime changes across the globe, China has been quietly working behind the scenes and leapfrogged the United States as a result of meticulous long-term planning. Incredibly, Harvard Business Review, the same journal that doubted China ten years ago, just released an article highlighting the four key factors that have led to China’s meteoric rise.

In today’s newsletter we are going to break down the work of Mitch Presnick and James B Estes Harvard article and explain the four major keys to China’s economic dominance and reveal to you how China surpassed the West to become the world leader in tech.

Innovation Ecosystem

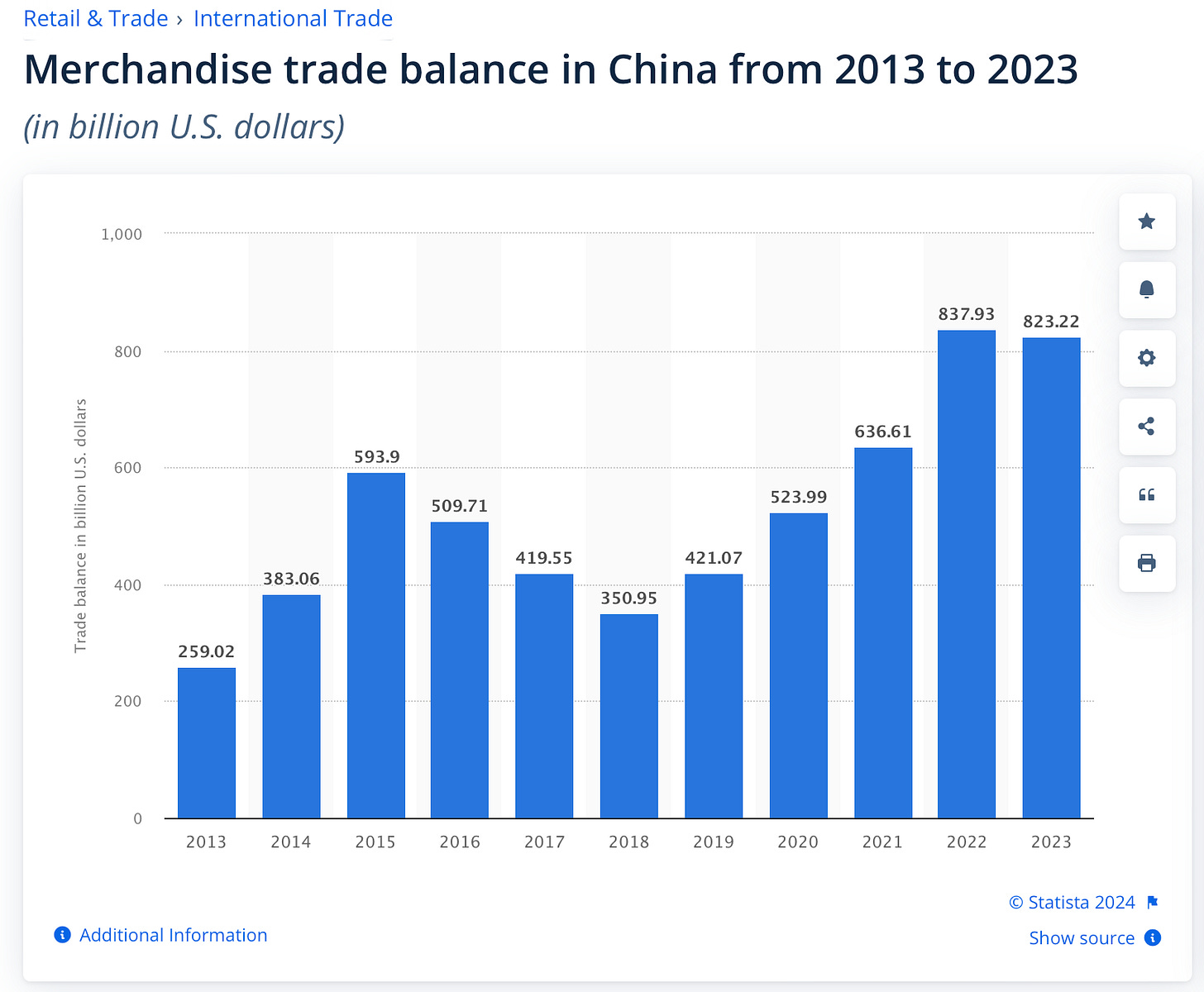

The first major key to China’s success is its Innovation Ecosystem which uniquely combines top-down government support with the bottom-up drive of Chinese entrepreneurs. This is in large part due to China operating at a trade surplus of a whopping 823 billion dollars in 2023.

The government picks key growth industries of the future and supercharges them through favorable policies, regulations, and centralized investment in scientific research. Contrast this with the United States, where industry growth is much more dependent on shareholder value and short-term gains. Firms in the U.S. may recognize that certain industries are the future, yet are much slower to invest in them, as they are focused on maximizing profits in the immediate future and are much less willing to invest long-term. The government also plays a much lesser role.

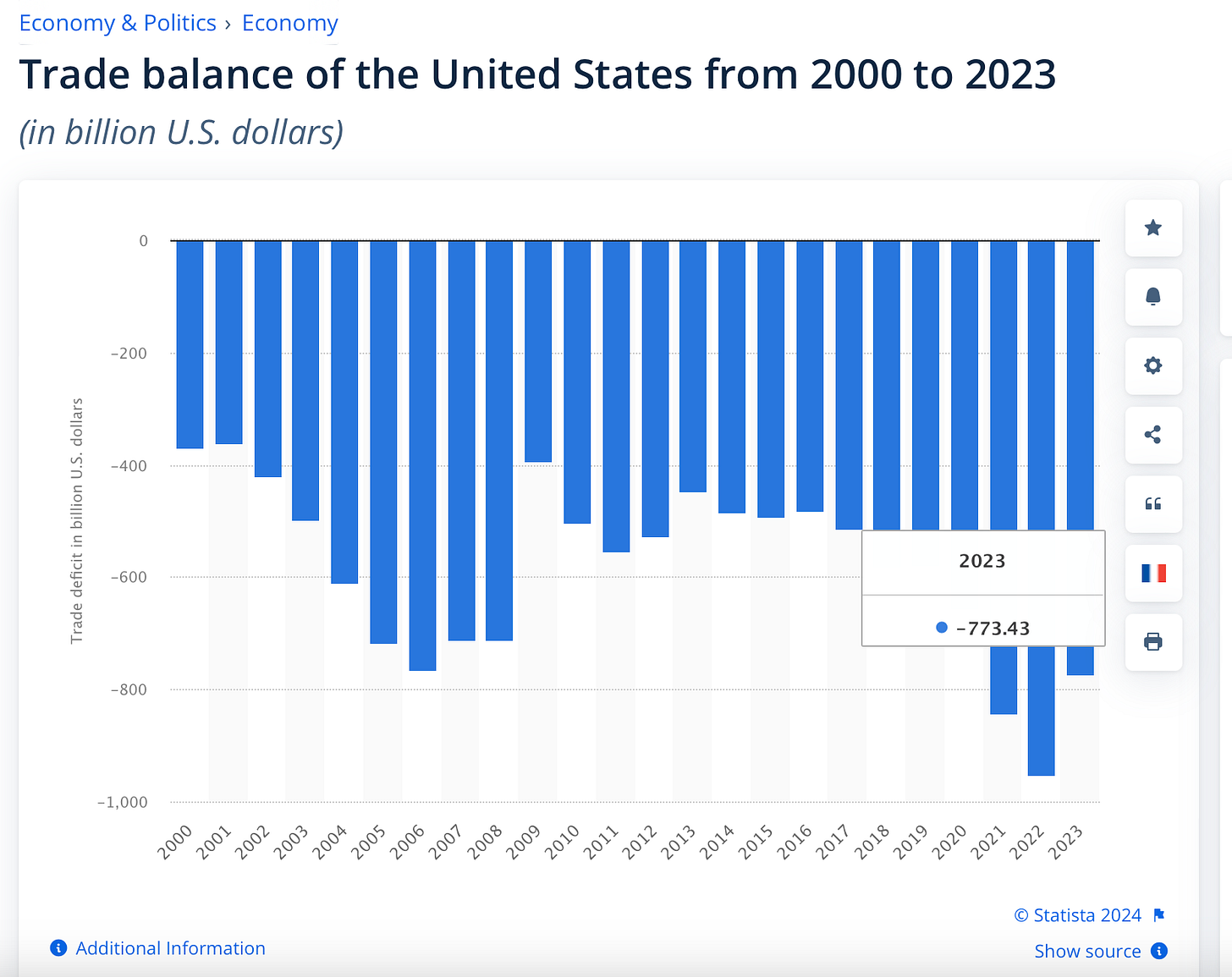

When the U.S. government does choose to invest in these industries, investment is always subject to change with different parties and budgets. In an almost exact opposite position to China, the U.S. trade deficit in 2023 sat at 773 billion dollars meaning the US imports much more than it exports.

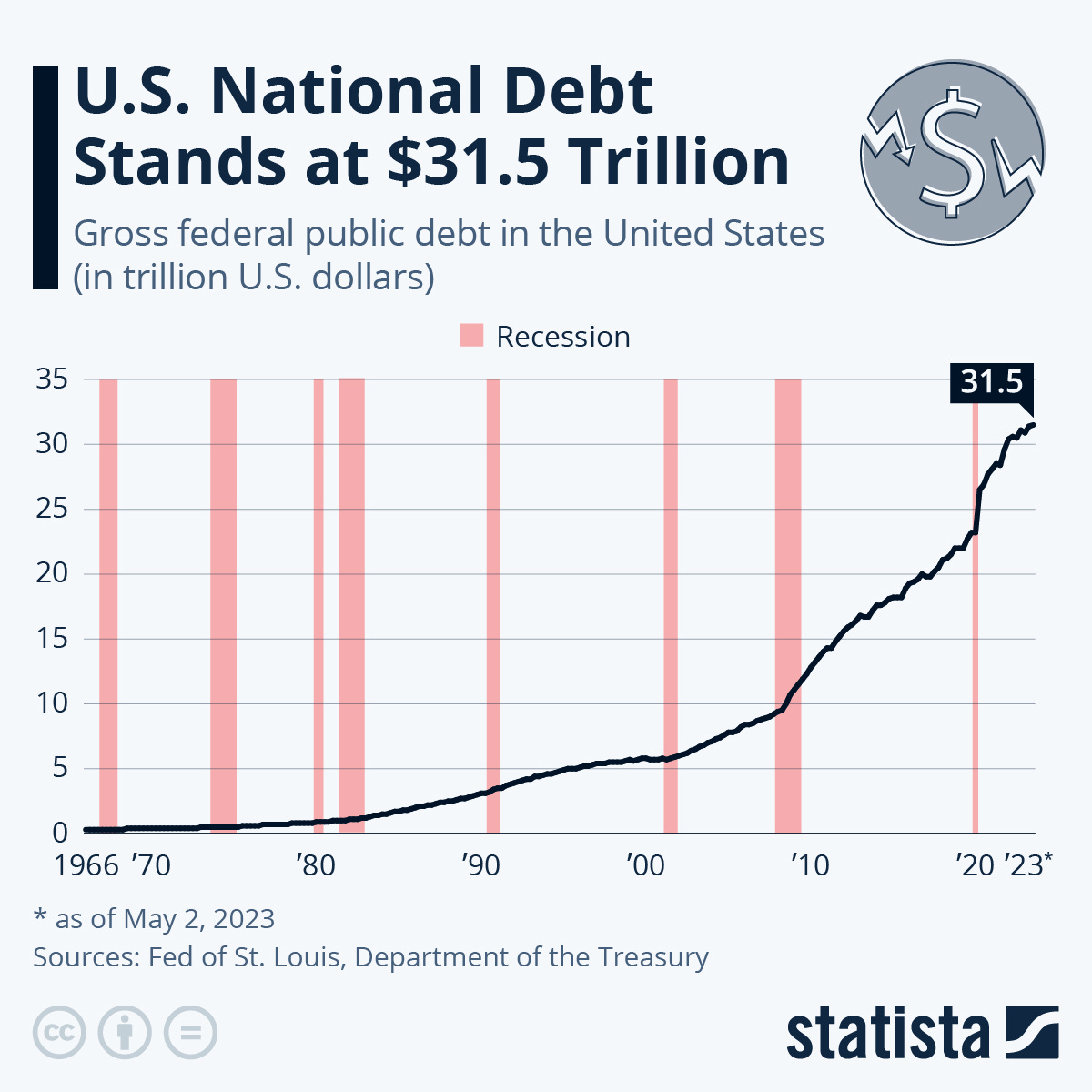

As a result, any government funding must be raised by printing money from the Federal Reserve, adding to the U.S. national debt of over 30 trillion dollars and pushing the world further towards de-dollarization. The approach towards innovation, which China calls the “whole-of-nation,” lets China marshal almost unlimited state resources.

From 1995 to 2021, China’s total R&D outlay soared from $18.2 billion to $620.1 billion—a 3,299% increase compared to America’s 277%. In recent years, U.S. profits and government stimulus have often gone into stock buybacks and executive salaries.

U.S. firms have become greedy and complacent, and research and development have become an afterthought. Meanwhile, China has become a leading global hub for advanced scientific research. Chinese scientists now lead the world in producing high-impact papers and contributing to famous scientific publications selected after rigorous peer review.

No segment better illustrates China’s technological prowess than clean tech. China now accounts for over 80% of global production capacity in 11 essential clean energy technologies and dominates the rare-earth supply chain, accounting for 70% of global rare earth ore extraction and 90% of rare earth ore processing. In the solar sector, there’s virtually no point in Western companies trying to compete.

After China opened up its economy in the 1970s, many Western companies moved in to take advantage of the massive market and cheap labor. In exchange for access to the market, Chinese companies benefited from decades of Western investments in traditional industries like cars and chemicals. This willing transaction of expertise for markets is the source of the stereotype that China steals technologies.

Ironically, it is now the West asking for Chinese companies to come to their countries and share their expertise in critical technologies like clean energy. One of the largest U.S. renewable energy developers, Invenergy, has seized the opportunity to benefit from China’s investment in solar. This year, the company opened the biggest solar factory in America in a 51/49 partnership with a leading Chinese solar company, LONGi Green Energy Technology.

As part of the deal, Invenergy acquired LONGi’s advanced solar technology. The Ohio facility is expected to eventually produce 5 GW of solar panels annually and create more than 1,000 new jobs. If the US is going to stay committed and met its climate change goals the only way to achieve this is by partnering with Chinese companies.

Ford is another U.S. company that has recognized that Chinese technology is indispensable to its green ambitions. Ford recently announced a joint venture with CATL, China’s dominant EV battery manufacturer.

Ford is investing $3.5 billion into an EV battery factory in Michigan that will use licensed CATL technology to cost-effectively produce lithium-ion batteries for Ford’s F-150 Lightning trucks and other EVs. For all the talk about how China is the largest polluter, the country is undeniably the largest single player in the green energy transition—not only for China’s transition but for the entire world. Essentially without China, become a carbon neutral planet would be impossible.

Investment in the Global South

The second major key to success is China’s investment in the global south. Western countries have historically targeted their products at other high-income countries and looked to the global South purely for extraction. China on the other hand knows what it is like to be a poor, developing country and sees these smaller developing countries around the world as China’s biggest opportunity.

After all, 6.8 billion people live in the global South. That’s 85% of the world’s population and as these populations grow, so will their demand for goods and new technologies. Through initiatives like the Belt and Road Initiative, China has built ports, railroads, and airports to help facilitate the global Southern increasing demand for goods. China’s BRI has invested 1 trillion dollars in over 150 countries.

Unsurprisingly, these initiatives not only ease trade but make China a much more appealing partner than the West, which has woefully ignored these markets since colonizing them.

Today we see China is starting to see how these investments into the Global South have started to pay massive dividends. Chinese smartphone companies have captured 76% of the smartphone market in India and more than 60% of the African market. The telecommunications company Huawei alone supplies 70% of the 4G network for the entire continent of Africa, while Chinese EV’s consumption is skyrocketing in the global South. In Latin America, Chinese companies hold a massive 86% market share of EVs and 40% of all total car sales.

Notably, BYD made a major move in Bogota Colombia selling the city 379 electric buses giving the city the second largest bus fleet in South American cities after Santiago Chile. What would the Global South look like today without China?

Basically there would have been zero changes. Western-funded infrastructure projects in these countries are virtually nonexistent and the rise and development of these emerging markets would have been delayed by decades. Once again without China, smaller countries across the globe would have had no chance to enter and compete in the global economy we now enjoy today.

Ultra-Competitive Markets

The third major key to China’s success is its ultra-competitive markets. This might come as a surprise to many Westerners who think that China’s government controls everything in the country, but there is a healthy, competitive local market that drives innovation throughout China’s domestic market. China’s domestic market is often described as a gladiator’s arena. Those who become victorious in this cutthroat domestic market are extremely formidable and able to dominate when moving onto the world market. Some of these victors you may have heard of, like BYD or Huawei.

Once Beijing decides an industry will be of significant importance, regional governments scramble to offer subsidies and other support programs. Hundreds of companies jump in and the majority of them will fail, but those that survive will be ready to dominate their respective industry on the world stage. Tesla is a great case study to examine.

Entering the Chinese market in 2014, Tesla was able to gain a major market share. This market entrance coincided with Beijing’s decision to prioritize the development of the country’s own EV industry, and the race was on. Local manufacturers like NIO, Xpeng, and BYD began producing high-quality EVs at competitive prices, challenging Tesla’s market position.

Within six years, 500 Chinese EV companies sprouted up, yet after fierce competition, only 100 remained in 2023. Of these, BYD surpassed Tesla as the world’s largest EV manufacturer in total number of cars sold in 2023. Tesla could no longer price its cars at a premium and began to lose market share, with newer Chinese EVs becoming too advanced and affordable. Tesla responded to the rapidly growing competition by cutting the price of its signature “Model Y” four times in 2023 alone.

China’s booming EV industry has now become so popular that it is an existential threat to foreign automakers in China. 15 years ago Chinese consumers stood in line to pay cash for the privilege of owning a Buick, BMW, Audio or Mercedes, but today most Chinese consumers have embraced the switch to EV cars and are embracing their local brands instead.

Chinese companies have offered a lifeline to German automakers by sharing their expertise to help German firms in the transition to EVs. Audi and FAW are working together on a $4.87 billion EV production facility in Changchun and BMW is investing $2.76 billion to upgrade its Shenyang plant for EV production starting in 2026.

German automakers that once transferred combustion-engine know-how to Chinese partners are now learning from Chinese EV makers, reversing the teacher-student relationship. These brands are desperate to regain their footing, as their ability to adapt to China’s market is not just essential to their companies’ survival but arguably to Germany’s economy as a whole.

1.4 Billion Consumers

And that leads us to the final key to China’s economic success is its 1.4 billion consumers. This is actually a very interesting point to observe because for many companies, expansion overseas is a necessity in order to drive enough revenue growth, but Chinese firms could easily focus on their domestic market alone and still become one of the largest companies in the world. The market is literally that big. If these Chinese companies do eventually want to venture outside the domestic market, they come out of the gate ready to dominate, as they already have scaled their business to a point where they can serve 1.4 billion potential customers.

This massive market doesn’t just help domestic companies thrive but ensures that foreign companies will do everything they can to access the Chinese market. China’s middle class alone has a population of 700 million tech-savvy people with disposable income.

Despite all the talk about companies “de-risking” and “decoupling” from China, the country still offers a market of unmatched scale with sophisticated consumers. Investment into the country and continued business with China is almost a guarantee, as ignoring the market means missing out on a major source of potential revenue. China is expected to grow to as much as 40% of global luxury spending by 2030. From cars to luxury items, many Western companies would collapse without the significant revenues they receive from the Chinese market

Using these four major keys to success, China has been able to dominate the vast majority of critical technologies and create the strongest industrial base in the world. Not only have they used them for their own advantage, but for the future of our world. Now that China dominates 90% of the world’s most important tech industries, it’s time that we in the West ramp down tensions and participate in China’s win-win partnerships because when China will control many of the major industries that will shape the future of our world.

China is pushed to the corner by Western countries, the only way to go is up.

China is converting extreme foreign pressure into progress.