BRICS Just Built the System That Will Replace the Dollar

The Bloc is Leveraging Their Near Complete Supply of Resources the West Can't Live Without

For 80 years, the US dollar has ruled the world. But everything just changed as BRICS, the super alliance of Brazil, Russia, India, China, and South Africa has revealed their latest plans to build a new gold standard and it’s going to change everything we know about global trade.

For many years, financial experts have speculated the BRICS alliance would create a new fiat currency to directly challenge the US dollar. But starting a new currency from scratch is a daunting task and BRICS new plan is going to be even more powerful than creating a new currency. Because it’s going to leverage the one thing BRICS has complete control over: the global supply of rare earth minerals.

This past week plans have been revealed for the creation of a dedicated BRICS Precious Metals Exchange. This platform will allow countries to settle payments not just in gold, but also in rare earth minerals which are assets so valuable that they’re literally defining current global geopolitics. If you want to build anything, from artillery shells to hypersonic missiles, or smartphones to electric vehicles, you need rare earth minerals. As a result, these minerals are perhaps the single most important commodity of the 21st century. But here’s why the BRICS alliance has all the leverage. The BRICS organization controls an astounding 72% of the world’s rare-earth metal reserves and if BRICS succeeds with this new plan, the entire global economy will never look the same again.

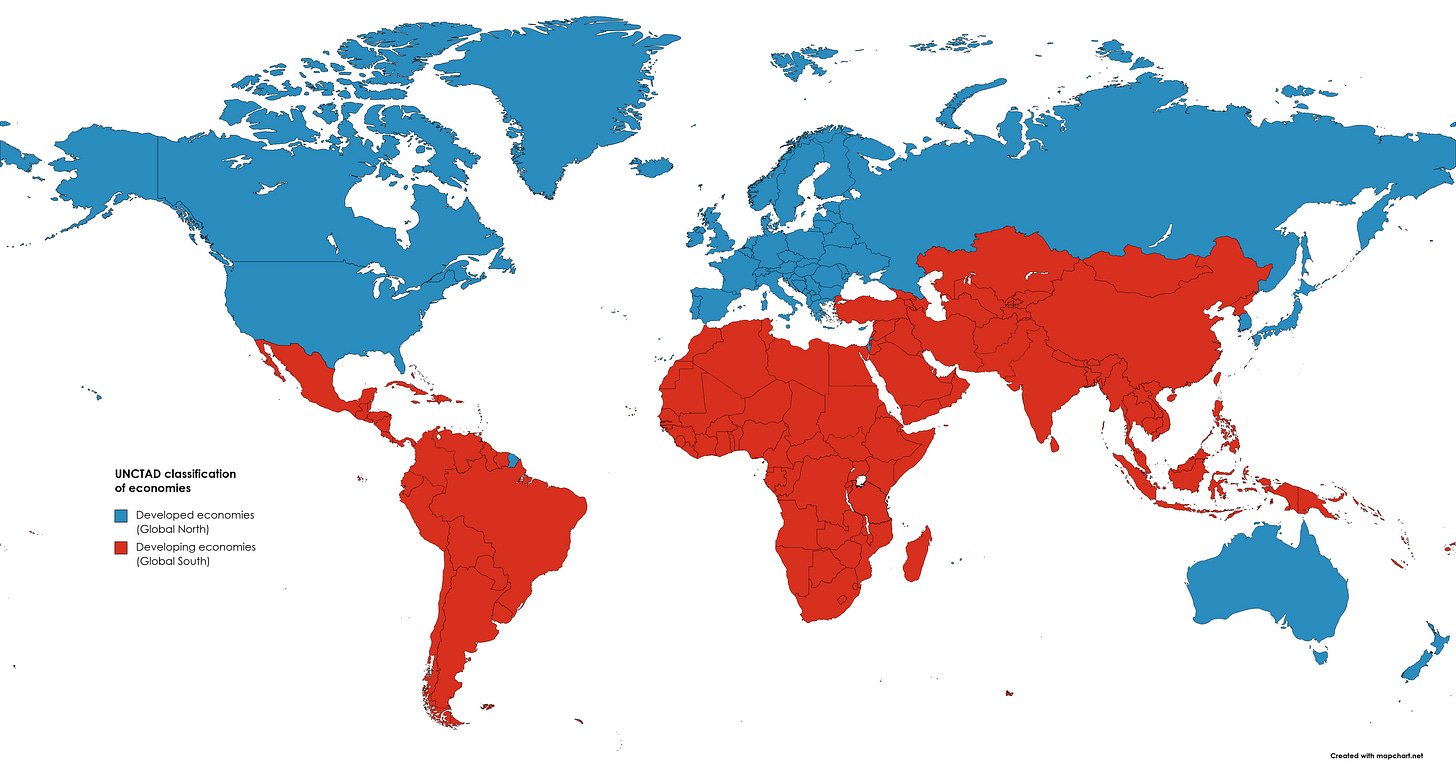

This is a brilliant move from BRICS because it’s a direct play that capitalizes on the West’s dependence on rare earth minerals. For all the posturing and prestige of the G7 countries, the truth is, without the Global South, they’re nothing. The numbers speak for themselves. Less than 15% of the world’s population lives in the West, while 85% of the world lives in the Global South, or what many geopolitical analysts refer to as the “Global Majority”. It’s about time that reality shows up on the global stage.

Earlier last month Russia hosted the 2025 Moscow Financial Forum which is one of the key financial strategy events for the BRICS alliance. This year’s game plan was to create their own benchmark for trading gold, platinum, diamonds, and rare earth minerals.

Historically, the exchange of precious metals and gold has been dominated by institutions like the London Metal Exchange, the Chicago Mercantile Exchange, and SWIFT. Unsurprisingly, these platforms have long served the interests of the Global North. For countries outside the West, these systems offer no inherent protection from sanctions, political attacks, or Western prioritization.

The BRICS response to this has been simple but revolutionary: build new neutral financial exchange mechanisms that are based on real, tangible transactions and don’t favor any single nation. No more dependence on London or New York. BRICS wants its own rules. After the war in Ukraine began, the global payment system SWIFT, based in Brussels, was weaponized against Russia. This move isolated Russia from the global markets, pushing them and many other countries to adopt China’s CIPS system. CIPS allows banks around the world to clear and settle cross-border payments in RMB instantly and directly. The creation of an independent pricing structure for precious metals is also a direct response to the weaponization of an already old and inefficient Western system.

For decades, the London Bullion Market Association has set the price of gold, determined by a handful of non-transparent British banks. Shockingly, after the start of the Ukraine war, this system has entirely excluded Russia, one of the world’s largest gold producers and sellers. Russia is the world’s largest country and the 5th largest holder of gold. They absolutely should be included in this system, and without them, it undermines the credibility.

In response, BRICS has taken the logical step of creating their own exchange, one based on actual market trading and transparent pricing mechanisms. This exchange, with the sheer volume of trade, will render the ability of Western powers to impose unilateral financial or commodity sanctions completely irrelevant.

While gold will always hold value, the real game-changer is the opportunity to trade rare earth minerals. BRICS controls 72% of the world’s reserves and processes 75% of them. The bloc also holds 70% of global cobalt and 50% of nickel, which are critical for EV battery production. On top of that, BRICS dominates 91% of niobium, the key ingredient for hypersonic weapons, and 40% of the world’s oil. They also control a third of global grain production and more than 12,500 tons of gold. With such an overwhelming grip on the world’s critical resources, BRICS is the gatekeeper to the 21st century. Once they organize this dominance into exchanges like the proposed Precious Metals Exchange, Western countries will be forced to play on an even field, one the rest of the world has long deserved.

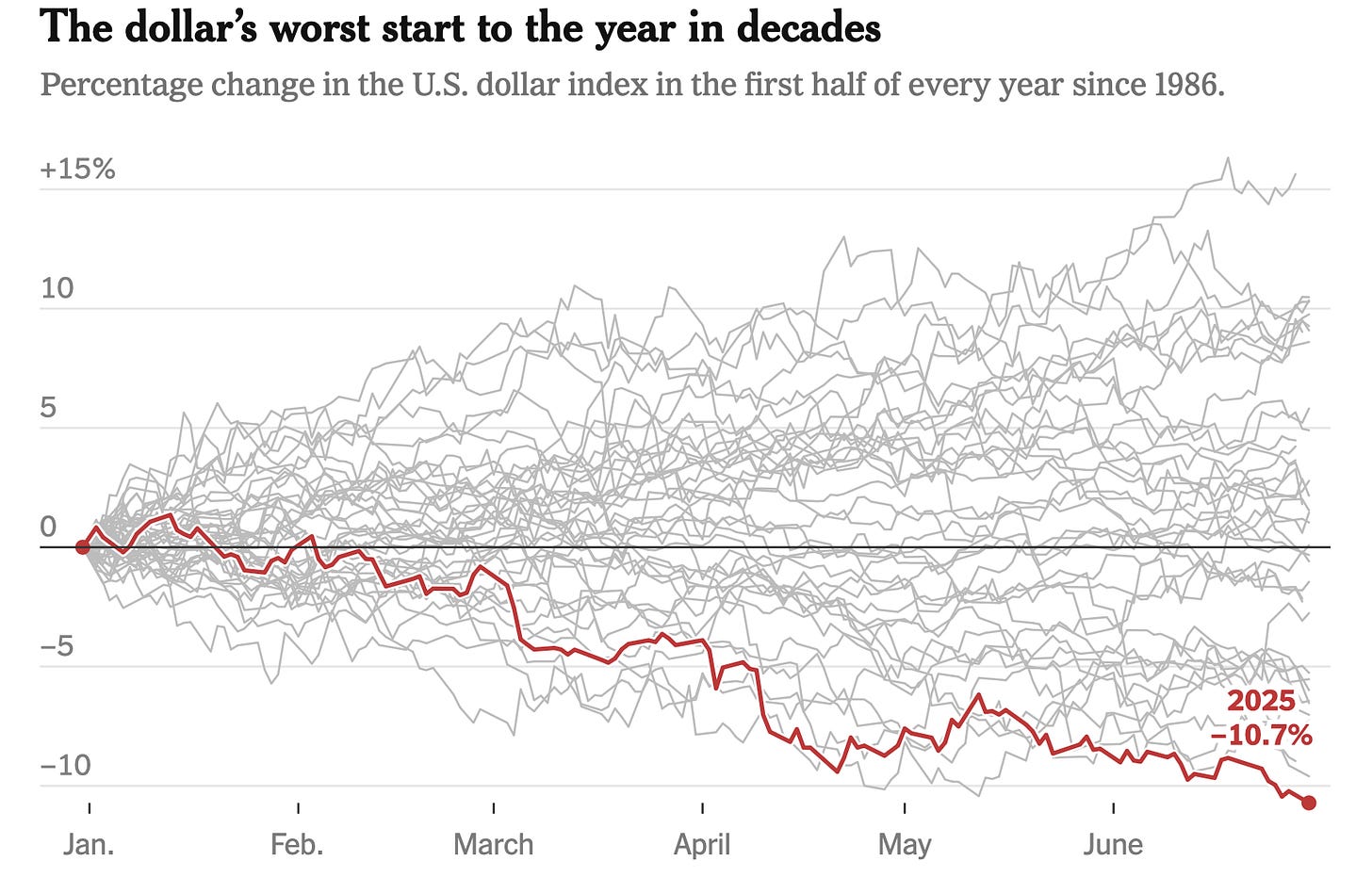

Every move BRICS makes is a direct challenge to the legacy structures that have defined the global order for decades, and none of these shifts are as rapid and as devastating as the decline of the U.S. dollar. 2025 has already become a historic year for the dollar’s downfall where the greenback has seen the worst decline since the United States abandoned the gold standard in 1973. Over just the past six months, the dollar has plummeted by more than 10% in comparison to other major world currencies. This is not just a result of erratic U.S. leadership under Donald Trump, but is also directly tied to BRICS’ de-dollarization strategy. Today, an astonishing 68% of BRICS trade bypasses the U.S. dollar, and nearly 90% of trade between Russia and China alone is done in their own currencies.

Both investors and world treasuries are quickly ditching the dollar. Global dollar reserves have been on a steady decline, dropping to 58% by the second quarter of 2025, which is the lowest level since 2000. As countries abandon the dollar, they’re flocking to tangible assets that will hold real value. Gold being the biggest reflection of this change as the BRICS bloc now holds over 12,500 tons of gold, with China and Russia alone holding nearly 2,300 tons. Even the U.S most strategic financial asset, the petrodollar, is under threat as Saudi Arabia is now accepting the yuan for 12% of their oil trades. The dollar’s dominance, which has long funneled global wealth into the pockets of Wall Street elites and fueled endless military conflict, is slowly dying a death of a thousand cuts.

And it’s not just Russia leading the way in these talks, BRICS as a bloc is making major moves. China is also creating alternative markets as the People’s Bank of China and the Shanghai Gold Exchange now want to start holding foreign central banks’ gold reserves. This is essentially a pitch to BRICS nations and the Global South: “Store your gold in China, not London or New York, and we’ll protect you from Western sanctions.”

After the US froze Russia’s $300B reserves in 2022, countries simply don’t trust the West. Undoubtedly, this will be an appealing proposition for countries on bad terms with Washington. Gold’s value is only set to rise, as it has just reached $3,787/oz, with Goldman Sachs predicting it to climb to $5,000. If China becomes the world’s gold vault, then it will be all but official that the dollar is dethroned.

This precious new precious metal movement is quickly gaining steam in Africa as well. Being situated on the continent with the most abundant natural resources, it should come as no surprise that African nations are rallying behind this initiative. For them, the exchange is a game-changer, offering an escape from the political leverage the unipolar world order has used against them for decades. For instance, Angola’s 80 million dollar Longonjo Project is set to supply 5% of global magnet metal demand, which is essential for electric vehicle and wind turbine production, through its rare earth deposits.

Nigeria has made massive developments to process more rare earth metals domestically, investing in a $400 million processing plant, signaling the country’s readiness to play a key role in the global supply chain. Nigeria is becoming an emerging power in the rare earth sector with the nation’s mining industry predicted to rise to 10% of GDP within the next two years. Unlike in the past, the new wealth generated by these projects can be channeled through emerging BRICS systems, rather than ones that heavily favor foreign firms. Africa has the unique opportunity to leapfrog Western legacy systems, as its economies are rapidly growing alongside the rise of BRICS’ new financial markets.

So how is the United States responding to being locked out of this entirely critical rare earth metal market? Well, historically whenever U.S. hegemony has faced major threats, especially when it comes to securing critical resources, the U.S. has not hesitated to deploy its military might. The Iraq War in 2003 is a prime example, where securing access to Middle Eastern oil was one of the central motives behind the invasion. Even Iraqi precious metal and gold stores were seized by American soldiers. Now, the stakes are even higher, as this exchange will challenge the United States ability to even operate as they can’t even produce any of the materials needed to maintain its military

The very weapons that power the U.S. military including advanced defense technologies like hypersonic missiles, are completely reliant on rare earth minerals. BRICS’ control over these resources is making them increasingly difficult for the West to access. One of the most critical minerals for the U.S. is Niobium, essential for hypersonic missile components due to its ability to withstand extreme temperatures. The U.S. Geological Survey has identified Niobium as the second most critical mineral for U.S. national security. For that reason, the resource is aptly named more valuable than oil. And Brazil producing around 98% of the world’s niobium, ensures the strategic advantage for the bloc. Brazil just happens to be a founding member of BRICS and has been heavily targeted by the Trump administration. So the chances that they will trade these minerals with the US and allow their military industrial complex to operate are slim to none.

Along with niobium, heavy magnets are a critical component in both electronics and military technologies and the numbers show how staggeringly far behind the West is. The most glaring is in the processing and manufacturing of heat-resistant rare earth magnets, which are vital for mechanical engineering, aircraft manufacturing, and all modern electronics. China holds a near-monopoly on the processing of rare earth metals, with its refineries producing over 99% of the three key rare earth elements needed for heat-resistant magnets. In terms of production, China manufactures at least 200,000 tons of rare earth magnets annually, while the combined production of the U.S. and the EU is less than 10,000 tons. The West is not just behind, it is literally entirely dependent on the BRICS nations for the supply of these crucial materials. With the U.S. not only potentially locked out of these crucial materials economically, but also potentially lacking the military capability to secure them, BRICS future success is all but guaranteed.

BRICS is reshaping the game. By controlling resources like gold, oil, rare earth minerals, and other critical commodities, they’re building a resource-backed financial system that directly challenges the U.S. dollar, which has long relied on debt and fiat currency. The dollar’s greatest strength used to be trust, but that trust is quickly unraveling. And now, BRICS is stepping in, offering a new alternative rooted in hard assets, economic sovereignty, and the global leverage they hold over essential resources.

As the West struggles with its dependence on these very resources, BRICS is turning that dependency into a strategic advantage. The world is shifting away from the dollar and toward a system backed by the actual things that power the modern world. The question now is: will the West adapt, or will they desperately cling to an outdated system of dollars and debt. The future of global trade and finance is being written, and BRICS is at the center of it all.

If you would like to see the video form of this article, plus many other similar fascinating geopolitical stories, please click the link to my YouTube channel below.

The Bretton Woods agreement of 1944 established the $USD as the international reserve medium which enabled the US to deploy $USD to settle international trade balances. Most nations then accumulated US dollars in their reserve accounts. This amounted to keeping a huge amount of a 'printed' currency overseas. In other words, these nations exported their resources to the US which 'paid' for them in printed paper, which essentially amounted to the kiting of cheques, never to be cashed. This is what France's Charles DeGaulle labeled America's 'exorbitant privilege'. France and some other countries demanded that significant portions of their retained $USD be exchanged for gold. The US post war gold holdings amounted to approx 30,000 tons. However, the flow of resources and goods became unbalanced to the point that US gold reserves dropped to less than 10,000 tons by 1971 and Richard Nixon was forced to 'close the gold window' and stopped the convertibility of foreign-held dollars into gold on August 13th 1971.

While the exchange rate for the USD dropped sharply at that time, it recovered again with the agreement of the Gulf oil producers to sell their oil only in $USD. However, the US balance of trade never became positive and foreign dollar holdings only increased. With the US perpetually running budget deficits, it was only a matter of time before all of the tricks, like quantitative easing, debased the currency and enabled the accumulation of debt to become unserviceable. The US deficit is projected to be $2Trillion this year, and short term Treasuries to the amount of over $8Trillion are due in this 4th quarter. There is no chance that domestic and foreign lenders (buyers of Treasuries) will be able to absorb this demand. The markets see this and recognize that further massive money printing will happen to allow roll-over of the maturing debt. Thus the dollar price of hard assets is going up sharply, which really means that the purchasing power of the currency is plummeting. Unfortunately, this will pull down most international currencies with it and everyone's cost of living will surge.

Building being the operative word. The world has seen enough death and destruction by the west with their one tool tool box of division.