Well things are changing faster than anyone could have predicted and yet we have news of another massive win for China as countries around the world are building new alliances and shifting strategies to combat that chaos Donald Trump has unleashed upon the world with his trade war. In an unprecedented move no one saw coming, the Japanese government has shifted away from the United States as the country is being forced to resist Trump efforts to form a trade bloc against China. The article states:

Japan intends to push back against any U.S. effort to bring it into an economic bloc aligned against China because of the importance of Tokyo’s trade ties with Beijing.

Japan doesn’t want to get caught up in any U.S. effort to maximize trade pressure on China by curbing its own economic interaction with Beijing, which is Tokyo’s biggest trading partner and an important source of goods and raw materials.

Although the U.S. hasn’t made any specific requests to Japan regarding China, Tokyo would prioritize its own interests if that occurs.

Japan has conveyed to China on multiple occasions that it doesn’t fully align with the U.S. on chip-related exports and semiconductor restrictions.

Japan has made a 180 degree pivot and is now effectively defending China from the United States. There's no overstating how transformational this is, because Japan has always aligned itself with the United States. I mean let’s not forget Japan is home to over 120 active US military bases, the most of any nation outside the United States.

But here is the main point that Donald Trump is missing in his trade war. Countries will always act in their best interests and it’s not in anyone’s best interests to cut off trade with China or support a US led trade bloc against China, who let’s not forget is the #1 trading partner for over 120 countries around the world.

But here is where things get very interesting...because Japan’s government has been so shocked from the treatment it’s received from the Trump administration that it has broken Japanese culture of being quiet and reserved and Japanese officials are now speaking to the world and exposing the truth about negotiating with Trump:

Let’s just be honest, this trade war is embarrassing Trump and the United States on the international stage. A few months ago, it would have been inconceivable to think Japan would ever compare the US government to an extortionist, but this Japanese government official is spot on in his reasoning. If you give money to someone extorting you, they'll just come back to extort you again, and this is why Japan is so vocal in speaking out against Trump trade negotiations.

It’s now been over a week since Japan’s meeting with Trump and still there is no deal in place, largely because Japan can’t get an answer on what the US wants from a trade deal Even right wing reporters like Charles Gasparino from Fox News is calling out President Trump stating the biggest problem:

But even more incredible, is the comments from Japan’s government on how Trump’s team doesn’t even understand how to do basic math and calculate an accurate number for tariffs.

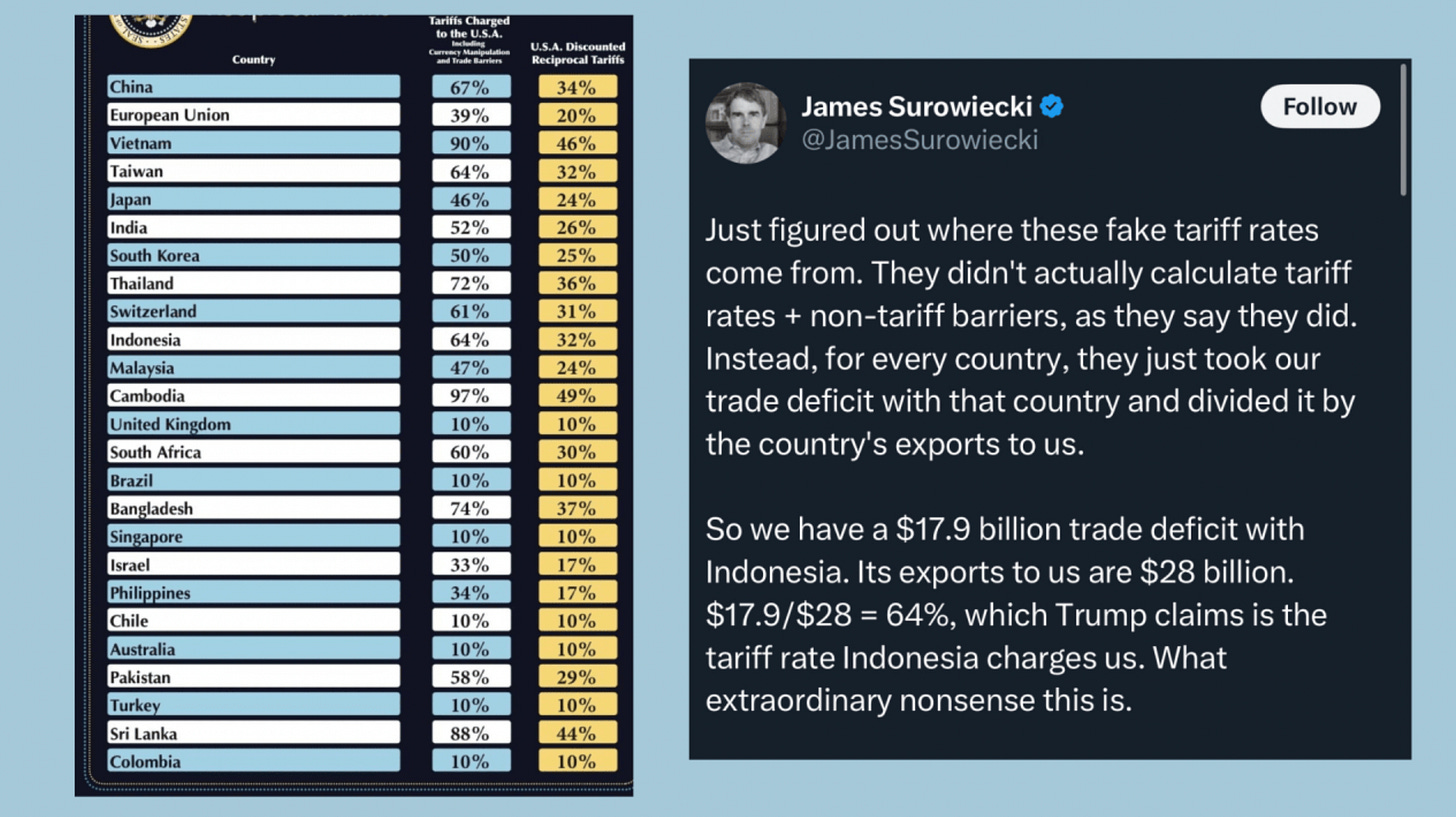

Once again, this is truly shocking to see a Japanese official break his cultural customs of being modest and non confrontational and speak so honestly about the US government’s actions. But when Trump is fabricating numbers to support his tariff war, countries have no other option but to speak out. Like this Japanese official said, if your opponent is not straightforward how can you show compassion? But let’s rewind the clocks and go back to April 2nd Trump’s famous liberation day, when he proudly took to the White House lawn and held up this tariff board announcing a new round of tariffs against every country in the entire world.

Take a look at this insight from journalist James Surowiecki who writes:

Of course this mathematical equation is completely inaccurate and it’s precisely why the Japanese official commented that this equation would score a zero in a formal math test. So of course the next logical question is — how do you actually calculate the real effective tariff rate? It's very simple:

You take the total amount of customs duties collected on goods from a country, and divide it by the total value of imports from that country. For example, let’s say the United States imported $28 billion worth of goods from Indonesia. If US Customs collected $560 million in duties on those imports, then you would divide $560 million by $28 billion. That equals 2% — meaning the real effective tariff rate is just 2%.

A trade deficit measures how much more we buy from a country than they buy from us. It has nothing to do with how much tax — or tariff — is actually being charged. So when Trump stands up and says Indonesia is charging us a 64% tariff, it’s complete nonsense. The real number is dramatically lower — because tariffs are based on duties collected, not the size of the trade deficit.

This is why Japan can’t strike a deal with Trump’s team. The people in charge of leading Trump’s administration don’t understand basic economics but this chaos and confusion have not only angered our allies around the world, they have started backfire on Trump domestically right here in the United States.

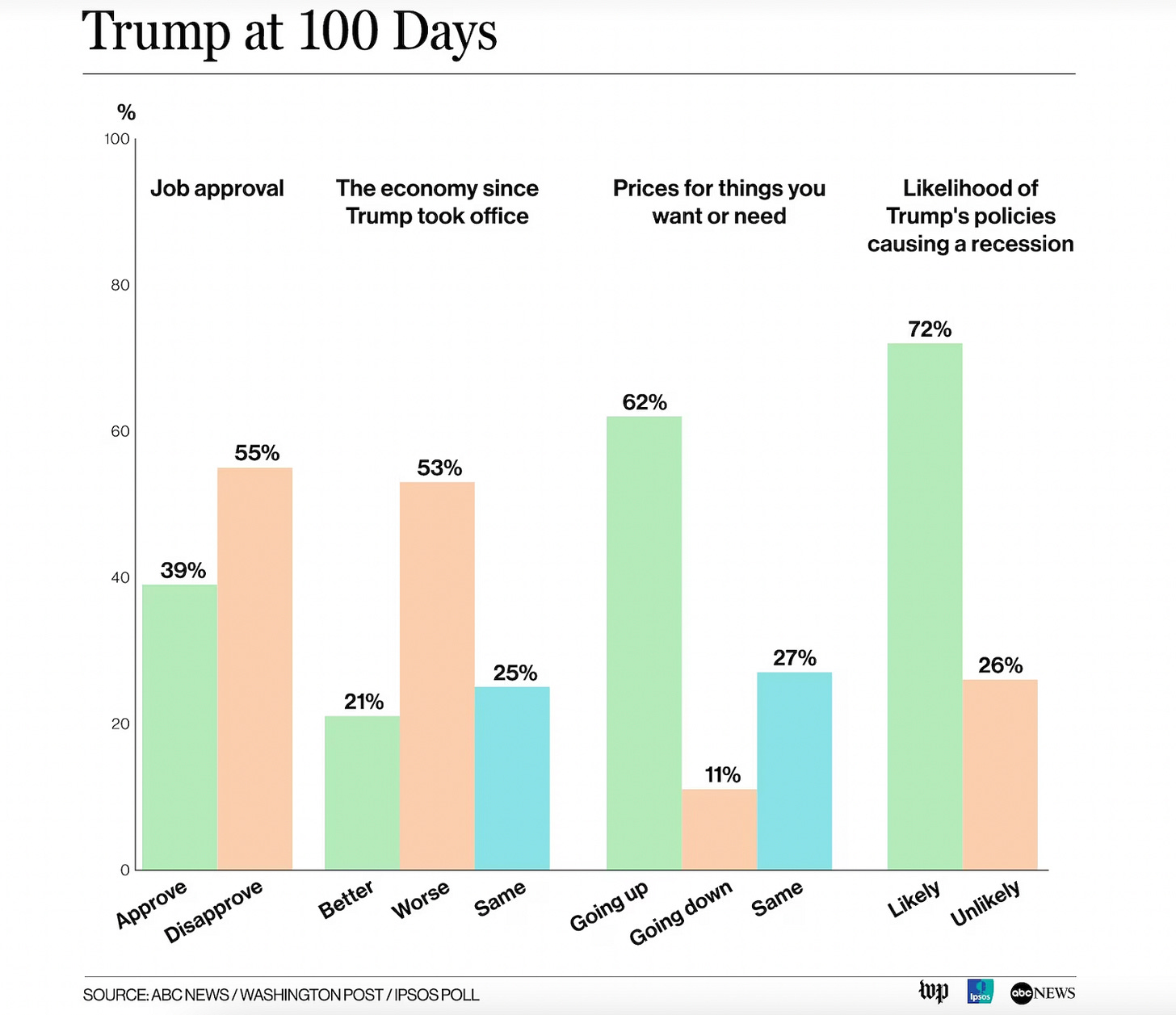

A brand new ABC poll this week shows that nearly ⅔ of Americans disapprove of Trump tariffs with over 71% of Americans now believing that tariffs will have a negative impact on inflation and sending prices skyrocketing for the average American consumer. Honestly we are beginning to see things unravel for the US President as it was announced earlier this week that Trump has achieved the lowest 100-day approval rating in 80 years. Perhaps most threatening to Trump, given his promise of an economic turnaround, is the extent of negative views on the economy.

But here’s where things get even crazier for the US. China is the world’s largest supplier of the raw materials, parts, and components that factories need to make finished products. Even if a product isn’t made in China, it almost certainly contains parts or raw materials sourced from China. Today, every factory in Europe, Southeast Asia and Latin America can all purchase these materials from China at standard market prices. But American factories?

They’re forced to pay a 145% premium on the same Chinese goods because of tariffs. The reality is, these tariffs didn't isolate China — they isolated American businesses. While the rest of the world continues to manufacture goods more efficiently and affordably, US factories are stuck operating at a significant disadvantage — driving up costs, shrinking margins, and pushing manufacturing jobs even further offshore. In the end, the tariffs became a self-inflicted wound on American competitiveness.

If you want a single metric to show whether Trump’s tariffs are “bringing manufacturing back” to the U.S., look no further than the Philadelphia Fed Manufacturing Index—and the latest numbers are brutal.

In April, the index came in at –26.4, a massive collapse from 12.5 the previous month and far below the expected 2.2. That’s one of the lowest readings in recent memory, and it tells you everything you need to know. Manufacturing in America isn’t coming back—it’s falling apart. And here's why: to manufacture anything, you need inputs—raw materials, parts, and components.

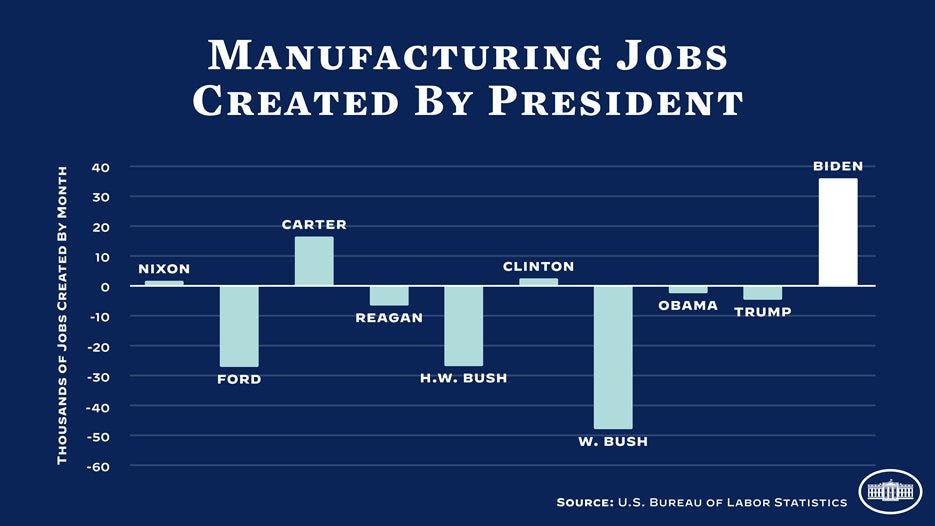

According to the National Association of Manufacturers, 56% of all U.S. imports are manufacturing inputs. If you slap tariffs on those or make them harder to get, you don’t revive American industry—you cripple it. Once again here is where the great irony comes in for the United States, because if we look at the data from the US Bureau of Labor Statistics it was actually President Biden who created the most manufacturing jobs by any US President over the past 50 years.

But let’s be honest, Trump policies will not bring manufacturing jobs back to America and this sentiment is being echoed by some of America’s most prominent voices, like Ken Griffin the billionaire hedge fund manager from Citadel who warned that the US is putting its global brand at risk as a result of the tariff policies. He shares:

Trump dreams of giving people their dignity back, and I have to applaud him for having that dream. But the dream is not going to come true. These jobs are not coming back to America. And to be clear, with an unemployment rate of 4%, America has moved on.

America has moved on but luckily for investors other countries are open for manufacturing and I’m actively looking at opportunities in Canada right now. The country is united under new Prime Minister Mark Carney and I’d like to switch to the investing portion of today’s newsletter and tell you about a unique opportunity in one of THE most important sectors for the future of our world.

It’s no secret that our planet is literally drowning in plastics but the global plastic waste crisis is actually an amazing business opportunity and today’s newsletter sponsor Aduro Clean Technologies has a powerful solution that’s not only going to change the world but also provide an excellent revenue stream to turn waste plastic into valuable resources.

Every year the world produces around 400 million tons of plastics but incredibly, only 9% of that number is recycled! 50% of plastic waste ends up in the landfills with another 22% leaking into the environment. The world is changing, industries are shifting to renewable energy, consumers are shifting to electric cars, and there is a global movement towards more sustainability. North American and EU regulations now mandate recycled content in packaging and as a result the chemical recycling market is forecasted to grow from $15.7B (2024) to $149B (2034), that’s a 10x increase in the next decade!

Aduro Clean Technologies is redefining the landscape of chemical recycling through its proprietary Hydrochemolytic™ Technology (HCT) — a transformative platform that offers a fundamentally different and superior approach to processing complex plastic waste. In contrast to conventional pyrolysis or hydrogen-intensive systems, Aduro’s process leverages a water-based, lower-temperature chemical reaction to gently cut contaminated, mixed, and hard-to-recycle plastics into high-value outputs such as renewable fuels, specialty chemicals, and chemical precursors.

This next-generation platform operates is modular and at has operates at significantly lower energy intensity and has demonstrated with >90% yield efficiency, positioning Aduro at the forefront of sustainable, economically viable recycling solutions. - Imagine small scale efficient systems scattered in many different locations.

By eliminating the need for costly hydrogen and extreme temperatures, Aduro not only achieves substantially lower operating costs, but that factor which enables also enables the scale up able operations for the truly circular use of post-consumer and industrial waste, and with this more waste plastics takes part in the circular economy. Furthermore the HCT process is scalable and can adapt to varying locations. Imagine small scale efficient systems scattered in many different locations. addressing a critical global challenge with a commercially attractive solution.

Aduro’s differentiated value proposition has already attracted engagement from multinational energy and chemical leaders, including Shell and TotalEnergies (market cap: $136B), underscoring the platform’s relevance, scalability, and potential for global impact.

Just last month Jesse Sablon from Boral Capital gave a positive outlook and financial forecast for the company issuing a buy rating with a $50 target, which would imply a 10x upside from currency levels. The stock has already appreciated over 45% the past year. Sablon estimates the discounted free cash flow to be roughly $63/share while the discounted EPS valuation is $37/share average out to $50/share and exactly where he thinks the stock could be going if the company can execute its 2025 plan accordingly. Aduro is listed on the Nasdaq and is already producing revenue from paid evaluations but has a long-term upside from licensing and scaling its proprietary recycling system.

We study geopolitics because it moves markets and there is a very bullish case for a company like Aduro as the world moves closer to renewable energies and environmental friendly policies. With increased environmental regulation and ZERO direct competitors Aduro has an incredible timing advantage. Their business model allows for both near-term revenue AND long-term scale. This market is underserved and there is a tremendous potential to turn some 91% of wasted plastic materials into high end resources for a variety of industries.

Everyone, I personally love highlighting companies like Aduro because they are changing the world for the better and in this case using advanced technology to not only solve one of the most important problems of the modern world, but also create a valuable and sustainable business model that will allow it to expand its global reach even further. If you are interested in learning more about Aduro, please check out the following links for more information:

🔹 Tickers: NASDAQ: ADUR | CSE: ACT | FSE: 9D5

🔹 Click here for Aduro Clean Technologies Website

🔹 Click here for Aduro Clean Technologies Investor Presentation

🔹 Click here for Aduro Clean Technologies Fact Sheet

🔹 Click here for Aduro Clean Technologies Analyst Report:

Please consult your financial advisor before making any investments and as always, thank you for reading our newsletter.

Cyrus

What should we expect? There isn't one.single.thing. coming out of this administration that doesn't scream IDIOT!

Japan is not going to be stuck in a room with a drunken minor who just found his daddies revolver and insists everyone play Russian roulette.

Interesting trade bloc may be China, Japan, Taiwan, Korea, Viet Nam.