Last week NATO concluded its 75th Anniversary Event in Washington DC. It was supposed to be a symbol of unity, strength, and most importantly a chance to announce that Ukraine would have a formal pathway to NATO. Unfortunately for NATO, none of that came to pass. Just listen to the words of former US Ambassador Chas Freeman who reveals what the summit actually accomplished:

“Instead of strengthening NATO and showing its power, the summit did the opposite. It laid bare its cracks, its failure to deal with reality, and its incapacity to respond to the emergence of multipolarity”

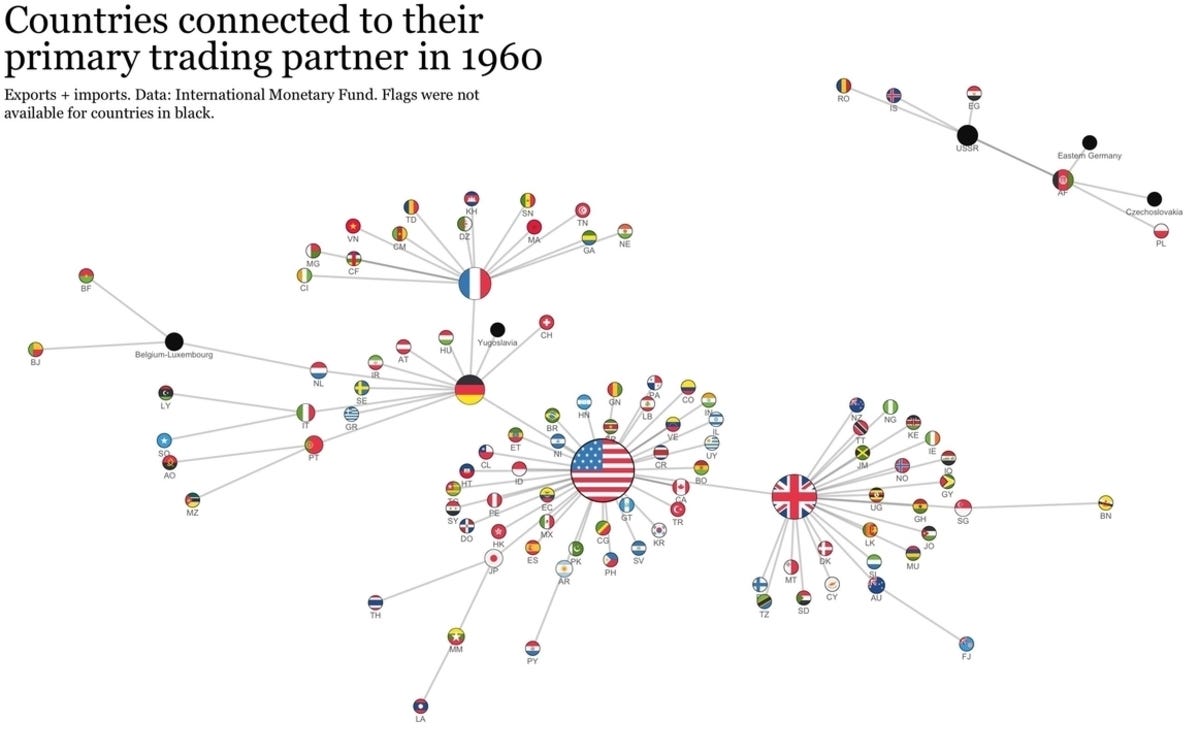

I want to focus on that last word “Multipolarity” because it’s probably the most important word in modern day geopolitics. At the end of WWI, the world was “unipolar”. The United States was the sole superpower and the US Dollar was king. With the emergence of the SWIFT banking system, the United States government and financial system was in control of the world and this is what world trade looked like in 1960:

But fast forward 40 years and the changes couldn’t be more different.

By 2020, China was the dominant trading partner for the majority of the world. Germany still serves a primary role as the engine of the EU economy, but this is what multipolarity represents, the emergence of multiple “superpowers” with the two greatest being the United States and China.

With the emergence of China, developing countries around the world now have options and China has employed one of the most successful foreign policy programs the past decade with the Belt and Road Initiative, inviting over 150 countries and making huge tangible progress for developing nations throughout the Global South, areas comprising of Latin America, Africa, the Middle East, and Southeast Asia.

Even the new Republican VP nominee JD Vance admitted in a speech last year why China’s foreign policy has been so successful:

The days of US hegemony and a unipolar world are officially over and this is why we’ve seen such an intense rivalry between the US and China emerge. Smaller developing countries now have options and trade alliances like BRICS, founded by Brazil, Russia, India, China and South Africa, have now become the chief rival to the American led G7 alliance.

The BRICS alliance is gaining tremendous momentum. In the past month alone, new reports indicate that Turkey, Malaysia, and Thailand are now all interested in joining the alliance later this year. In the future, this new multipolar world will give a serious challenge to the status of the US dollar as the world’s reserve currency and here are 3 emerging trends you should be watching:

BRICS Growth - This October, Russia will host the annual BRICS Presidents meeting and discuss which new countries will be admitted into the alliance. There are over 40 countries interested in joining the alliance with every nation in Africa at least expressing an interest in joining BRICS. Over time this alliance will continue to grow and give more pressure to the US and the G7

Debt - The US Government National Debt increases by $8 billion dollars EVERY day. This is absolutely absurd and dangerous as the US government’s addiction to wars across the world is simple unsustainable. We are sending billions to Israel, billions more to Ukraine, and are now looking at a new potential war with China over Taiwan.

Dedollarization - With the emergence of BRICS, countries around the world are shifting away from the US dollar in international trade. For example, India and Russia have announced a new partnership that will allow for seamless cross-border transactions without the need for U.S. dollars. Their stated goal is to increase the trade volume between Russia and set a goal to achieve $100 billion in trade turnover between Russia and India by 2030.

Everyone I started my YouTube channel and newsletter to help more people stay informed on geopolitics around the world and it’s with great pleasure that I tell you about today’s newsletter sponsor Lear Capital, which plays directly into this exact trend of dedollarization and the incredible rise of gold we’ve seen in the last two years.

Lear Capital is my trusted precious metals supplier and who I use as a resource to learn more about Dedollarization and how it will affect my investments and financial future.

The primary reason I partner with Lear Capital is because they offer a tremendous amount of value. I’ve used their free reports to become a smarter, more informed investor and if you haven’t already, please check out their report entitled Digital Dollars, De-Dollarization & Debt which is completely free and goes into further detail everything I’ve laid out in today’s newsletter.

In addition, if you are interested in learning more about precious metals investing, or a Gold IRA, simply reach out to Lear Capital directly. Gold and Silver IRA’s have become one of the most sought-after wealth protection opportunities in the world.

The benefits are ideal for those who wish to protect their retirement dollars with a physical asset that has stood the test of time as an effective portfolio diversifier. Lear walks you thru the entire process and are happy to answer any questions. Again, I can’t stress this enough…Use them as a resource and educate yourself.

To get started simply

👉 Call them today at 800-489-6450

👉 or go to https://www.learcyrus.com

Exclusive Offer

Lear Capital always rewards my viewers with an exclusive offer available to my newsletter subscribers. Open or rollover an existing IRA or 401k into a self- directed IRA, with ZERO set up fees and FREE insured delivery on your gold and silver purchase. For gold or silver purchases outside of your IRA, Lear will give you FREE insured delivery to your door. Offer ends July 31st so call today.

Lear Capital is America’s most trusted gold IRA company, and when dealing with your nest egg, you should only do business with the best.

As always, thank you for your incredible support and I look forward to seeing you in our next newsletter soon!

Cyrus

Greetings Cyrus,

Since Substack doesn't allow me to update my expired credit card, I can't choose one of your, subscription renewal offers. I suspect I am not the only one with this problem. I am 81 years old and therefore would never agree to any automatic credit card renewal. Furthermore, Substack doesn't allow reply to their email. I don't know who they are or where they are located.

Thank you very much Cyrus for sharing the important News and the fascinating graphics on the evolution of global trade